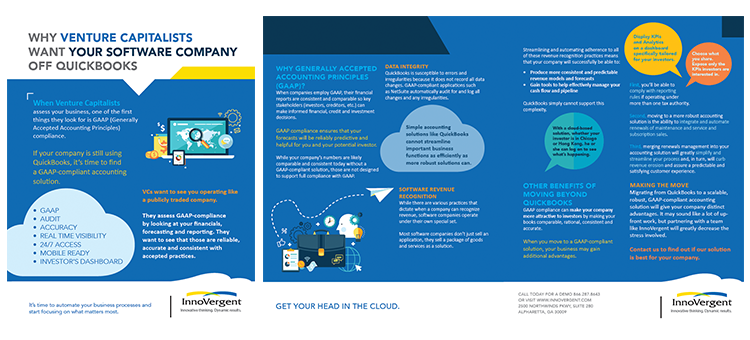

Why Venture Capitalists Want Your Software Company Off Quickbooks

*This article is part 2 of a series. Check out part 1, too!

Click to download the datasheet.

When Venture Capitalists assess your business, one of the first things they look for is GAAP (Generally Accepted Accounting Principles) compliance.

If your company is still using QuickBooks, it’s time to find a GAAP-compliant accounting solution.

- GAAP

- Audit

- Accuracy

- Real time visibility

- 24/7 access

- Mobile ready

- Investor’s dashboard

VCs want to see you operating like a publicly traded company.

They assess GAAP-compliance by looking at your financials, forecasting and reporting. They want to see that those are reliable, accurate and consistent with accepted practices.

Why Generally Accepted Accounting Principles (GAAP)?

When companies employ GAAP, their financial reports are consistent and comparable so key stakeholders (investors, creditors, etc.) can make informed financial, credit and investment decisions.

GAAP compliance ensures that your forecasts will be reliably predictive and helpful for you and your potential investor.

While your company’s numbers are likely comparable and consistent today without a GAAP-compliant solution, those are not designed to support full compliance with GAAP.

Data Integrity

QuickBooks is susceptible to errors and irregularities because it does not record all data changes. GAAP-compliant applications such as NetSuite automatically audit for and log all changes and any irregularities.

Software Revenue Recognition

While there are various practices that dictate when a company can recognize revenue, software companies operate under their own special set.

Most software companies don’t just sell an application, they sell a package of goods and services as a solution.

Streamlining and automating adherence to all of these revenue recognition practices means that your company will successfully be able to:

- Produce more consistent and predictable revenue models and forecasts

- Gain tools to help effectively manage your cash flow and pipeline

QuickBooks simply cannot support this complexity.

Other Benefits of Moving Beyond QuickBooks

GAAP compliance can make your company more attractive to investors by making your books comparable, rational, consistent and accurate.

When you move to a GAAP-compliant solution, your business may gain additional advantages.

- First, you’ll be able to comply with reporting rules if operating under more than one tax authority.

- Second, moving to a more robust accounting solution is the ability to integrate and automate renewals of maintenance and service and subscription sales.

- Third, merging renewals management into your accounting solution will greatly simplify and streamline your process and, in turn, will curb revenue erosion and assure a predictable and satisfying customer experience.

Making the Move

Migrating from QuickBooks to a scalable, robust, GAAP-compliant accounting solution will give your company distinct advantages. It may sound like a lot of up-front work, but partnering with a team like InnoVergent will greatly decrease the stress involved.