Staying on top of revenue recognition is a major challenge, and the rules keep changing—such as with the introduction of the latest EITF 08-01 and 09-03 rules affecting revenue recognition on multi-element sales. But most ERP systems like SAP, Oracle and Microsoft Dynamics GP aren’t up to the task of keeping pace with the changes. This means finance teams often resort to complex spreadsheets that sap finance productivity, harbor substantial risk of error, limit visibility and introduce significant compliance risk.

NetSuite Advanced Revenue Recognition completely automates your revenue recognition processes. It also provides a cloud solution that integrates with existing ERP applications such as Oracle Financials or SAP R/3 to provide automated revenue management. And if you’re already using NetSuite as your ERP solution of choice, NetSuite Advanced Revenue Recognition can be easily added on as a module.

NetSuite Advanced Revenue Recognition provides complete support for all key revenue recognition standards, automates revenue recognition calculation, and delivers dashboards and reporting for continual revenue recognition monitoring.

Benefits:

- Efficiently meet necessary revenue recognition standards and comply with AICPA, FASB and SEC regulations

- Improve finance productivity and reduce the cost and time of calculating, recording and reporting on revenue recognition

- Reduce or even eliminate the use of spreadsheets, dramatically reduce errors and gain strong, compliant processes

- Get strong processes and higher accuracy by ensuring the proper review, approval and execution of the revenue that’s due to be recognized

- Gain clear visibility and continual monitoring for all aspects of the revenue recognition process, from summary to detail through to Estimated Selling Prices and key variances

- Extend your existing Oracle Financials or SAP R/3 deployment quickly and efficiently thanks to NetSuite’s cloud delivery

- Get ongoing support for the latest revenue recognition rule changes with automated upgrades

Support for all Key Revenue Recognition Rules

- Comply with AICPA, FASB and SEC regulations (including SOP 81-1, SAB 101, EITF 00-21, EITF 08-01 and EITF 09-03)

- Recognize revenue for each line item according to its revenue recognition method

Effective Revenue Recognition Management on Multi-Element Sales

- Track and support “units of accounting” and selling price (VSOE, TPE or ESP) for all elements of multiple-element arrangements

- Deliver automatic reallocation of order value to each line item

- Assign flexible and customizable schedules on a per-item basis

- Track and manage multiple Estimated Selling Prices (ESPs) for every SKU

- Compare current trending actual selling prices versus Estimated Selling Price, and get exception reporting for data integrity.

Flexible Revenue Recognition Capabilities

- Support revenue recognition schedules for all sales transactions

- Receive immediate notification when revenue is due to be recognized

- Recognize revenue as a job is completed, thanks to support for percentage of completion-based revenue recognition

- Flexibly recognize revenue using a separate process from billing, or use an integrated workflow for simultaneous revenue recognition and billing

- Manage one-off and recurring billing processes for subscription and maintenance-based revenue streams

- Gain multi-currency and multi-subsidiary business intelligence.

Integrate with SAP, Oracle or Augment NetSuite Financials

- Deploy and integrate with your existing ERP system such as Oracle Financials, SAP R/3 or another 3rd party ERP system. Or simply add-on to an existing NetSuite Financials deployment

- Supports bi-directional integration between your existing ERP deployment and NetSuite Advanced Revenue Recognition

Provides functionality for importing orders and invoices from your ERP for revenue recognition calculation and reporting, while also exporting journal entries back into your ERP systems General Ledger.

Pre-packaged or Custom Revenue Recognition Templates

- Use revenue-recognition templates to define revenue-recognition methods and apply them at the line-item level of your invoice

- Associate a template to a good or service for related recognition rules to apply whenever that good or service is sold

Use either pre-packaged templates, which capture common recognition methods, or create your own highly specialized custom templates.

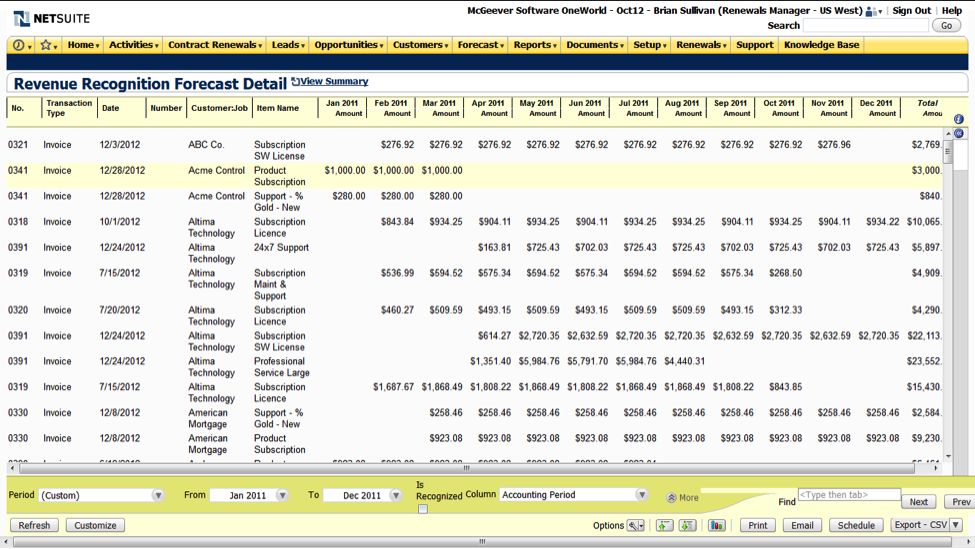

Delivers Clear Reporting and Visibility

- Monitor your recognized revenue continually with NetSuite’s real-time dashboards

- Generate key reports such as revenue recognition forecast, deferred revenue by customer / item and revenue by customer / item

- Easily examine breakouts of recognized revenue across various elements

- Get a clear view into Estimated Selling Prices, enabling you to ensure accuracy

- See in detail into the transaction level, ensuring that you can be confident in reporting your financials

- Enable monitoring of key variances between areas such as Estimated Selling Price and Actual Sales Price

- Create sophisticated revenue and deferred revenue reporting with analytics by region, product line and more.