NetSuite OneWorld addresses the complex multi-national and multi-company needs of mid-market organizations. Enable businesses to adjust for currency, taxation and legal compliance differences at the local level, with regional and global business consolidation and roll-up. Get unprecedented visibility of your business worldwide in real time, ensuring consistent, compliant management across the organization, locally and globally.

NetSuite OneWorld can populate a single charts-of-accounts across subsidiaries, or use separate charts-of-accounts for each company with postings between subsidiaries such as expense allocation managed via inter-company journals. Local taxes are readily handled across subsidiaries with an embedded tax engine that allows for multiple tax schedules for everything from GST, to VAT, to consumption tax or general sales tax. Revenue recognition, local financial reporting and compliance are also built-in components. And OneWorld allows for global order management and sourcing with the ability to manage inventory and fulfillment across multiple locations with product items represented globally or on a per subsidiary basis.

Benefits

- Multiple levels of consolidated reporting. Multi-currency management with automated currency rate updates ensures reports accurately reflect currency conversion

- More rapid financial close. Real-time management and financial automation capabilities can significantly reduce time to close.

- Cost reduction. You can staff back-office operations centrally—or in low-cost locations—and the same employees can handle operations across multiple subsidiaries

- Global order management and sourcing. You can manage inventory and fulfillment across multiple locations with product items represented globally or by each subsidiar

- Simplified tax management across borders. NetSuite OneWorld’s tax engine accommodates multiple tax schedules for local taxes across subsidiaries, GST, VAT, consumption tax or general sales tax, and more

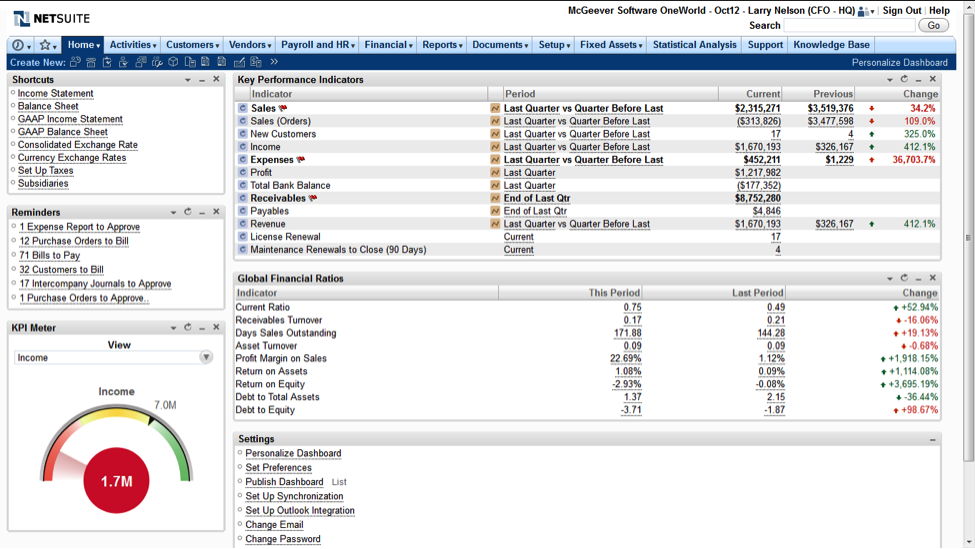

- Unprecedented worldwide visibility into operations. Role-based dashboards and “drill-down everywhere” provide instant insight across the corporate hierarchy of subsidiaries

- Unparalleled integration. One database provides a repository of all your worldwide business data, eliminating the need for data warehouses or multiple systems at each local site.

Global Accounting and Consolidation

- NetSuite OneWorld provides global accounting and ERP capabilities that deliver multi-currency business consolidation of financials and real-time roll-up across accounts receivable, accounts payable, payroll, inventory, billing, invoicing and order fulfillment from local in-country operations, to the regional office, to global headquarters.

- Multiple levels of consolidated reporting displayed on dashboards

- Documented consolidation rates:

- Average (P&L)

- Current or historical (for Balance Sheet) rates on an account specific basis

- Automatically calculated Currency Translation Adjustments (CTA) that result from using these different methodologies

- Ability for users to go back to any historical period and see all of the detail related to CTA and consolidation entries

- Significantly faster time to close

- Local entity and inter-en

- Automated management of revenue recognition

- Streamlined closing processes into a few highly auditable steps

- Tight internal controls and easy-to-follow audit trails

- Multi-national compliance.

Multi-Currency Control

- NetSuite OneWorld supports multi-currency management in all financial areas including accounts receivable, accounts payable, payroll, billing, invoicing, etc. Uniquely, it supports multi-currency management and roll-up in the sales business process, including quota management, forecasting, quotes and orders, order management, and commissions. It provides finance departments with the required ability to maintain all currency exchange rates—both the local currency conversion rate and the rates used to determine roll-up into corporate currency—at the time an order is placed or the commission payout is made, ensuring accuracy of historical sales data

- Multi-currency management and roll-up in all financial areas, including order management, forecasting, quota management and commissions

- Multi-currency consolidation support, retaining historical rates of currency to ensure accuracy of historical sales data including:

- the local currency conversion rate

- the rates used to determine roll-up into corporate currency

- the rates used at the time an order is placed, or the commission payout is made

- Automated currency rate refreshes as rates change worldwide

- Corporate headquarters or a parent company with accurate currency translation

- Multi-currency forecast roll-up within and across multi-national sales entities